As the Council searches for ways to recover debt, and the Council Administrator suggests a visitor parking tax, others have started to think up other ways of how the Central Coast can make money.

One suggestion that could solve two issues in one is imposing a bed tax on the increasing number of Airbnb’s and Stayz properties popping up on the Central Coast.

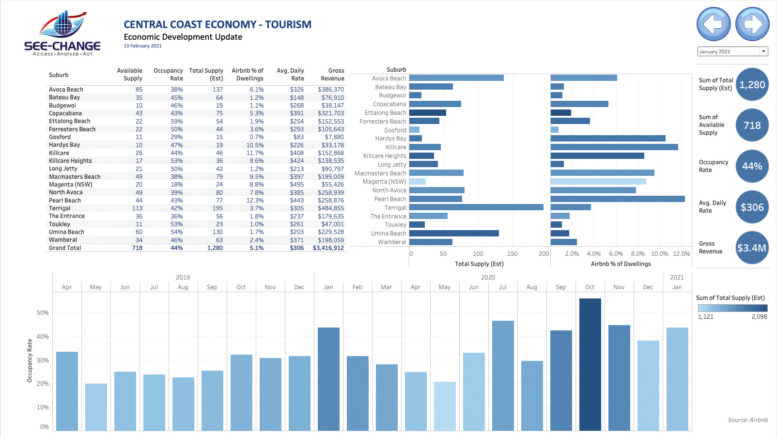

Patrick Spedding from See-Change Analytics has been collecting data from both companies for the last year and has estimated that on average over $70M a year is collected by vacation homeowners, many of whom are not Central Coast residents.

Speeding said he calculated his figures by multiplying the average revenue from both Airbnb and Stayz over November, December and January by 12 months.

“The gross revenue generated by the short-term rental market (Airbnb and Stayz), based on the Airbnb data I collect, shows in November Airbnb made $3,045,957 and Stayz $2,605,151; December, Airbnb made $2,534,496, and Stayz $3,339,692; and in January, Airbnb made $3,416,910 and Stayz $4,257,473,” Spedding said.

His research also found there were 1,280 Airbnb dwellings alone on the Central Coast in January, with an occupancy rate of 44 per cent and an average daily spend per night of $306.

Spedding acknowledges these statistics might be swayed as COVID has influenced the chosen months, however, he said the point is to show how much money could be made if a bed tax was applied.

“That equates to over 3,000 active listings (Airbnb + Stayz), with an average of three rooms per booking,” he said.

“Total Airbnb nights booked in January were 11,000, which works out to around 30,000 rooms for the month, or an average of just under 1,000 rooms per night (Data for Stayz is similar).

“The short-term rental economy exceeds the hotel economy on the Central Coast, yet is unregulated, and generates little by way of direct employment or revenue into the local economy.

“Essentially, there are over 3,000 properties in residential areas being run as businesses; that don’t employ people and generate income that mostly doesn’t benefit the Coast; that put additional stress on the community infrastructure and decrease social amenity, yet don’t pay any fees or taxes to Council.

“When I’ve asked Council, I’m told they “don’t have the resources” to regulate Airbnbs, even though many are advertising more bedrooms than allowed under the LEP.

“Economically, we’d be better off with more hotels and less Airbnbs.”

The idea of imposing a “bed tax”’ may also help solve the rental shortages across the coast, specifically near the beaches.

All suburbs still have an average rental vacancy rate below 1 per cent, with the average sitting at 0.5 per cent.

“A healthy rental vacancy rate is around 3 per cent, according to industry sources.”

Other data revealed in Spedding’s latest research shows building approvals were also down during December, a year over year decrease of 17.6 per cent.

This is in stark contrast to October, which saw a year over year increase by 148.8 per cent.

Jacinta Counihan