Thousands of first home buyers will no longer pay stamp duty with the introduction of a fairer, simpler First Home Buyers Assistance Scheme (FHBS).

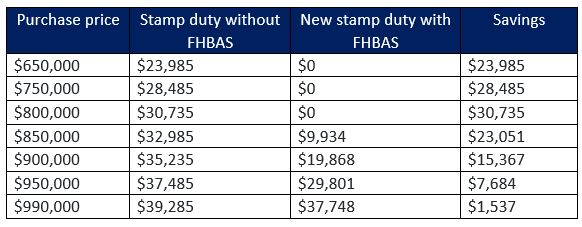

From July 1, the threshold for stamp duty exemptions will increase from $650,000 to $800,000 and the threshold for stamp duty concessions will rise from $800,000 to $1M.

It means first home buyers purchasing a property up to $800,000 will pay no stamp duty, saving up to $30,735 under the changes.

Based on the current housing market, NSW Treasury expects about 8,600 first home buyers in the $650,000 to $800,000 range to pay no stamp duty over the next year, and about 4,400 first home buyers in the $800,000 to $1M range to pay a concessional rate of stamp duty.

NSW Treasurer Daniel Mookhey said the former government’s unfair “forever” land tax scheme gave people paying between $1M and $1.5M much larger stamp duty reductions than those able to afford homes up to $1M.

The former scheme closed on June 30, 2023.

Buyers who opted in will continue to pay property tax until they sell that property.

“July 1 was a great day for thousands of extra first home buyers who will now pay zero stamp duty on their first home purchase,” Mookhey said.

“These changes will help five out of every six first home buyers pay no stamp duty, or a concessional rate, and deliver a key election commitment.

“The changes implemented ensure first home buyer assistance in NSW is simpler and fairer, helping those who most need support.

“We know stamp duty can be a considerable barrier for first home buyers.

“The changes will allow thousands of first home buyers to enter the market sooner and give them a boost when competing with other buyers.”

Source:

NSW Treasurer, Daniel Mookhey